Executive Summary

The executive stakeholder of this insurance brokerage wanted to make sure their renewal and retention efforts were working but didn’t have a good way to measure who renewed. The client wants to know the retention rate of qualified clients.

Challenges

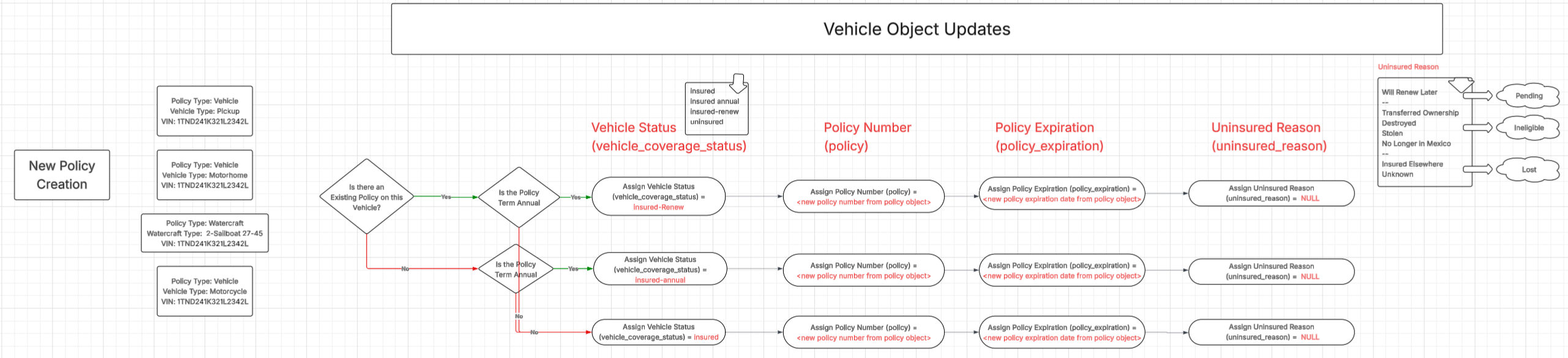

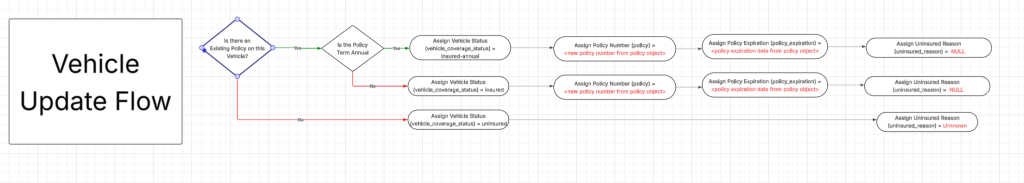

The customer was using a Salesforce CRM where all customer data was being stored. The current renewal processes and flows were dependant on the Policy Object, and the Policy Object had a lookup relationship to the Contact record and the Vehicle Object.

Some customer change vehicles, or renew a policy outside of the renewal function process, so it is not properly flagged as a renewal. And vehicles that were destroyed, or no longer eligible for coverage there was no way to determine if a vehicle was no longer eligible for coverage, for reasons like sale, transfer, stolen, etc.

Solution

The solution was to modify the vehicle object to lookup to the policy object. The vehicle object needed new fields, like policy expiration, insured status, and uninsured reason. These three new fields will provide the data necessary to keep better and more accurate track of renewals by analyzing the vehicles, and not the policies.

Scope

- Update the Vehicle Object to include 3 new fields

- Run a one-time flow to update all vehicles

- Run a scheduled nightly flow to update vehicle fields related to insurance coverage

- Create 3 new reports

- Upcoming renewals (30 days)

- Pending Cancel (expired within 7 days)

- Lost Clients

- Create 1 new Dashboard

- with all reports

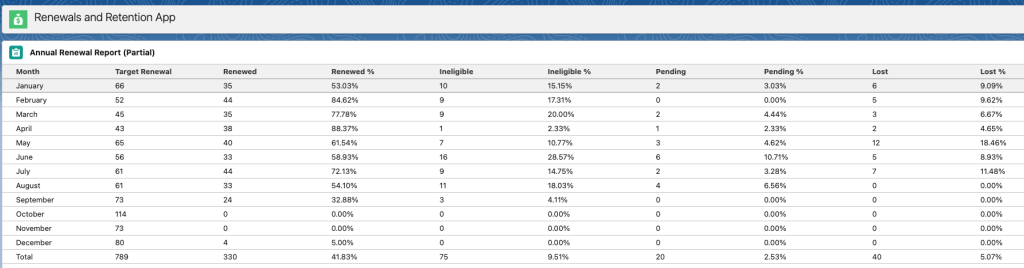

- Create 1 Apex Report taht summarizes renewal and retention that analyzes by current month:

- Eligible Renewals

- Renewals

- Pending Renewals

- Ineliglbe for Renewal

- Lost